Buying Out Co-Founder 50% of Supplement Business

Why I did it despite the very anti "do one thing"

Early September I bought out my co-founder’s 50% of the Futuro Labs (health supplements on Amazon).

This is after saying I wanted fewer things…. One large project….

So this might be hypocritical, but the maths was just keeping me up at night based on the actual potential profit to hourly rate.

This business is NOT a very time-intensive business.

The hours of input per month (before doing this) was very low, probably under 5/month.

After the admin, cleaning out the costs, fixing a few processes and around 50 hours of work one-time, the business should be very much in the 1 hour per week range (to keep the same).

That’s not to grow but to just keep the same.

Growth is another decision which is a post for another day, as this is not a brand I want to be working on, the big SH brand which will hopefully launch at the end of this year is the one that will take the most time/energy/capital etc.

But for today I wanted to discuss the economics with FL and add this to the business reports monthly along with the sports betting P/L’s and (once launched) the big SH project.

To reiterate: FL (Futuro Labs) is not a lifelong project.

SH: (big real brand) IS a lifelong project. The brand I want to be associated with, potentially forever.

Futuro Labs Maths, Buying out co-founder & Next 30 Days

Buying out co-founders (in general) feels very similar to acquiring companies, except you already know everything about the business and don’t have any “hidden risks” (for the most part), if you trust the individual you set it up with, which I do.

So why not continue together then?

I think it comes down to different goals and skills.

Futuro Labs is low time intensive business.

The issue is it’s also very difficult to grow.

We tried PPC (which I knew was a poor decision) but tried anyway and this didn’t work.

And moving into 2025 onwards neither of us had any ideas on how to grow the business and wanted to work on other things.

As a result, we asked around and my co-founder found a “buyer” that put in a loose official offer of $55,000 (about £45,000) for 100% of the business, valuing my share at around £22.5k.

This was an incredibly lowball offer, but based on the issues we faced when we sold Evopure and the crazy delays with payments, if the offer was 100% cash and all upfront we considered it (and were going to accept it), until it just bugged me too much and I decided to purchase 50% at the same valuation.

So in short, £25k for 50% of the business.

Valuing the business at £50k.

Despite this going against the “one thing” point that I do believe is incredibly important.

But from a pure time-to-money (and energy) point, here’s why I made this decision.

The maths

I think the business will/is doing around £100-120/day gross profit. Which can easily increase to 120-150/day GP with a few tweaks.

Over the first few days of September so far we’ve been higher than this but if we assume a lower-worse-case scenario of £120/day GP figure.

For anyone unfamiliar of the difference between gross profit and net profit, below should explain;

Although I don’t love that explanation, so in this business, an example would be simplified to: “Gross profit is simply the cost associated with fulfilling one order” So if your product costs £5 and £4 amazon fees and delivery. You sell this product for £15 it would be: £15-£5-£4 = £6 gross profit.

Other costs such as accounting fees, marketing expenses, staff, everything else comes off before the net profit figure.

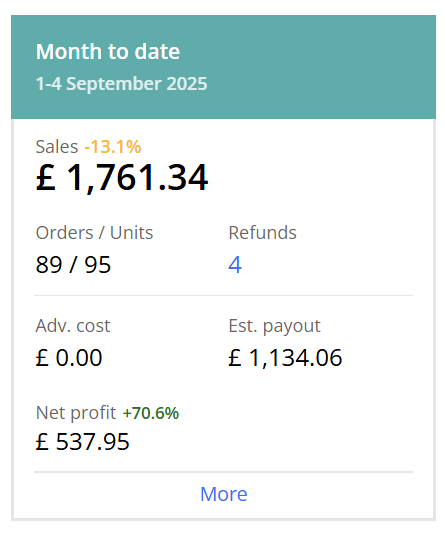

So in the first 4 days of September (although 4th has not completed yet so should be higher), we’re sitting at the below figures. **NOTE: the “net profit” is actually gross profit here as the software we use to track all this data does not bake in other costs.

So gross profit of, call it £560.

/ 4 days = £140/day GP.

To be sure we’ll just use the £120/day GP figure I mentioned above to be safe.

£120 * 30ish days/month = £3,600/Month Gross profit.

Fixed & variable costs are around £600 currently (although should decrease) so we’ll call this exactly £3,000/month net profit.

From here you can just decide how “good” your business is.

In general businesses that are “better” (yes I’m simplifying), get a higher monthly net profit multiple.

The bigger the business, the higher the multiple as well.

In general for this size, I think a 25X monthly net profit multiplier is valid.

So that’s 25x £3,000 = £75,000 business valuation.

I’d also argue that because this is a very easy business to manage (from here not from day 1) that the multiple could even increase to 30x, but we’ll leave it like this for now.

If the business tripled however, not only would the net profit double (obviously assuming no changes in relative ops cost/fixed costs etc, but let’s assume not for this example).

The monthly net profit would be £6k, but your multiplier would also increase.

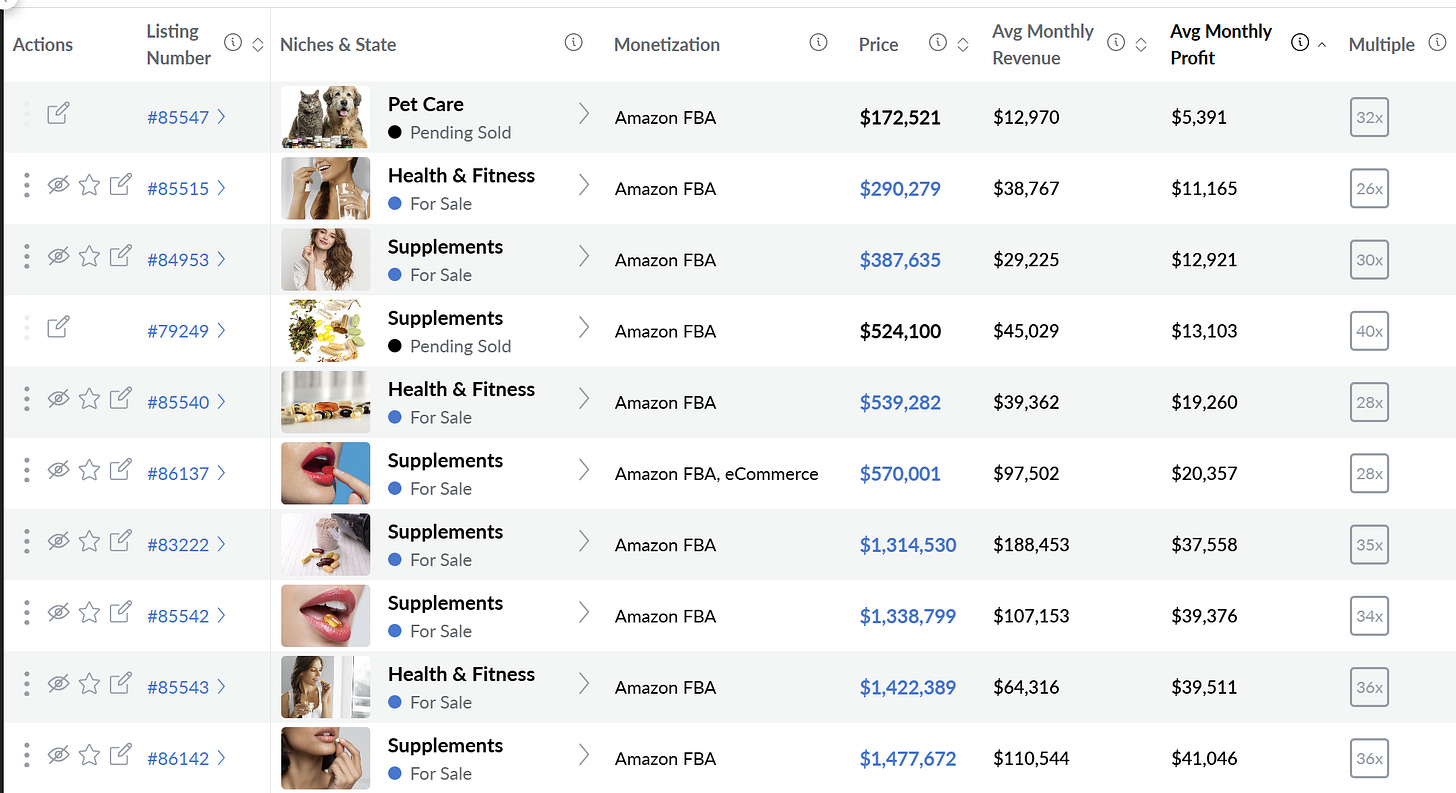

So instead of your business being worth £225,000. Based on the marketplace multipliers and this industry (screenshot below), you are looking at more of a 28-35x multiplier.

*the column "Multiple"

With some businesses getting as high as 40x and others a lot lower at 25-26x.

The reason these multipliers vary so much can essentially be boiled down to 3 things;

Risk of the business decreasing - Do you rely on one product for 90% of your profits? Do you rely on one supplier only? Etc.

Risk of the market decreasing - Are you selling newspapers or magazines in 2025.

Reliance & Control - Amazon FBA businesses are reliant on Amazon’s sales channels. If Amazon changes something or new competitors come in, you have no control over those factors.

This is also why the more sales channels you have (Ecommerce, Amazon, Walmart, Socials) the better multiple you will get.

So back to my point around the maths & buying the business itself.

This is why it all boils down to the multiple, even between 2 co-founders.

If I value the business at a 25X multiplier.

But my co-founder values the business at a 15X multiplier.

That’s where the difference lies on the pure maths side.

There’s obviously a million more nuanced points; will sales increase, will margins decrease, is the market shrinking, does Amazon suck (yes, easier one) and so on.

But factoring all these in, you get a multiplier.

15 x 3000 = £45,000.

25 x 3000 = £75,000.

It’s kind of that simple.

Along with the fact I think the multiple AND the net profit will increase over the coming weeks and months.

As a result, that value difference of opinion is where/why I purchased it.

Over the next 30 days.

The goal will be simply to cut the costs of the business, simplify operations and see where we are on a gross profit per day basis throughout September.

After this, I think the business will be around £4k/month net profit (not gross, but our fixed costs are pretty low, about £600/month, which will try to be reduced further).

Also after this period of 30 days and about 50 hours invested, assuming the normal expected outcome, the business will do around £4k/month on about 4 hours invested per month (operational time invested not growth time). So about £1,000/hour.

Which sounds great but it is only the operational time invested, tracking sales, reordering inventory, customer service etc.

This is not growth marketing time invested (as per below).

Over the next 90 days.

This is the tougher one, this is where the growth marketing investment (both capital and time) will be input.

It’s easy to say “get to 6k/month net” or some arbitrary goal, but that 50-100% net profit jump is a lot more difficult to do (especially in this business) than many people think.

It’s also a bit naive to use this as a pure concrete goal as very rarely will you do something that *exactly* increases your business by 50% or 100%. Usually you’ll implement things that somewhat work over time, bit by bit and the occasional home run that might increase things by 200% or more.

So aiming for X amount of growth can be a bit dangerous is the short version.

The 90 day goal is to just think about low time investment marketing strategies that can increase the growth of the business both gross profit and revenue.

I’ll be adding the FL data to the end of month reports, starting again in September, writing up the results of FL sales and gross profit as well as sports betting profit/loss and the new SH project once this starts up properly.

Everything else such as the marketing agency / skincare business I’m winding down and these are boring anyway vs those 3.