Fixing Housing with Georgist Economics

Wealth vs Income

Income taxes are too high.

This disincentives innovation, business and growth.

I recently watched a Rory Sutherland, probably one of the top two minds in OG marketing (along with Seth Godin) on the Modern Wisdom podcast.

Good pod, worth a listen in full.

The core takeaway I wanted to deep dive into was this idea of Georgism.

About being a “Georgist” instead of more vague labels; left/right/communist etc.

For someone pretty interested in economics, finance, investing, business, this is a term I hadn’t actually heard before, but something that resonated pretty quickly.

The main policy idea reduces income tax and fixes the housing crisis… So worth a crack.

The Problem - “Land Hoarding”

Land and rental monopolies are obviously a massive issue, especially in big cities (where more people want to live).

The issue is house prices and rentals have become incredibly unrelated to income whereas before the “gap” was narrower.

This is obviously nuanced, but to simplify the point, average house prices rise more quickly than average salaries.

Which further causes wealth (not income) inequality.

This naturally causes a shortage of good housing at affordable prices.

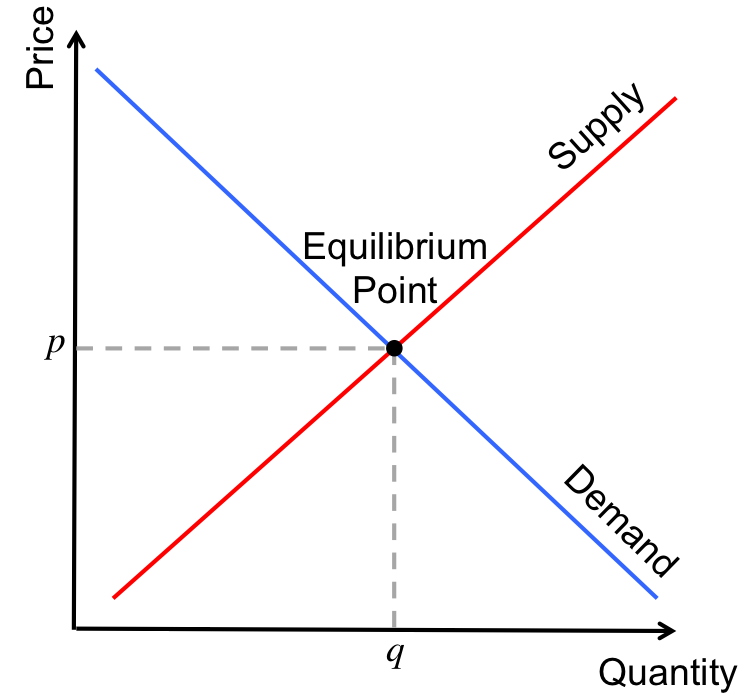

This (as supply is reduced), increases demand (rentals, buying etc) and hence price goes up.

Economics 101.

That’s a (very good) fact of the capitalist system.

If supply increase and demand decreases price will decrease, and vice versa.

You can view the OG chart below and think about examples, just move the lines and the equilibrium point will change, along with it price.

This is actually good for 99.9% of industries.

“Price go up, I buy less.”

Logical.

The reason why it’s fine is because you do not HAVE to purchase.

No one is forcing you to buy a specific good or service.

You make a purchasing decision based on the price vs value you think you will receive.

If the value is greater than the price, you purchase, if not, you do not.

It really is that simple in 99.9% of cases.

For an extreme example, if coffee was £500 per cup, or a banana was £50, people wouldn’t buy these items (or they would change to a status game/signal not a normally distributed good or service, but that’s a discussion for another day).

The consumer behavior would shift, from coffee and bananas to tea and apples presuming they stayed roughly the same price (although f*ck apples, the most overrated fruit).

Anyway.

If trains were cheaper, more people would use them and coaches/buses would suffer and vice versa.

You can build these incentives into systems, such as increasing taxes on alcohol and cigarettes or subsidising public transport to increase usage.

All logical enough.

But the issue with this logic when it comes to housing is that housing is not a choice.

You do physically need somewhere to live, a roof over your head.

I can’t say “I think house prices are a bit high at the moment, I’m going to wait for the dip” Or switch to apples instead, it just doesn’t work in this sector.

This is the core issue with house prices themselves and this issue is caused (albeit I’m simplifying) by how these assets are taxed and as a result hoarded for “easy wealth accumulation”.

I’m someone who’s business-first, so anything that reduces tax is generally good for business-first minded people, the issue is difference between taxing non-value-adding wealth and businesses or income.

Wealth; Property, stocks etc are taxed in a better way than income.

It’s a little hard to demonstrate simply but in short, you pay less tax on wealth related earnings than you do on income related earnings.

In most countries but specifically the problem is getting extreme in the UK.

So here’s the crux of the main problem.

Wealth inequality is more of an issue than income inequality

The example that’s always used is to explain wealth inequality vs income inequality is if Bill Gates walked into a football stadium with 50,000 people, the “average” person now has a net worth over £1,000,000.

But income is distributed more closely, the average income of that stadium does increase when he walks in but not by the same amount.

50,000 people, average net worth prior: £200,000.

Add in someone with 100B net worth.

Each person just added £2 million to their net average net worth (100B/50,000).

Income though doesn’t work like this.

50,000 people, average income £30,000.

Bill Gates net income for the year, I couldn’t find a consistent figure but it’s estimated around £300 million.

£300M / 50,000 = An extra £6,000 to each person’s income.

Impactful but nowhere near the same skew.

So why the f*ck is income taxed so much worse than wealth?

Incentives, corruption, all the usual fun stuff….

Simplifying…. Barely.

The UK £250,000 Example:

If I make £1,000,000 net profit in my business per year, I pay over 50% tax on this.

Despite all the effort, energy, risks, years of work, travel, expenses, stress and positive economic growth (jobs and all that good stuff) that this took to create.

This might be 10 years of grinding 10 hours a day, every single day, hiring and paying PAYE and National insurance on 5-10-20 employees and all the other knock-on benefits.

Here’s the breakdown:

25% Corporation tax: £250,000.

Of the £750,000 left over (to simplify, I’m taking all out as dividends): £278,648.41 is the dividend tax hit.

This is not even including all the actual taxes that a business owner already pays in NI and PAYE, but let’s just ignore that for now.

So £1,000,000 - £250k - £278k = £472,000 in pocket.

Essentially 53% taxation rate for successful business owners.

Monumentally dumb, but this isn’t just a rant on how bad UK tax rates are.

Instead let’s look at if I made this from property, stocks or “wealth” vehicles.

I’m going to keep this simply and just take the CGT (capital gains tax) rates for this example.

24% CGT….

£240,000.

But the real kicker is the lack of value that was provided, assuming these gains were from property related earnings as that’s the main discussion here, something that provided far less (sometimes even negative) economic stimulus, jobs, growth etc, gets taxed at 29% less than active income.

A real real problem.

Probably THE real problem.

It just massively disincentives UK business owners and founders.

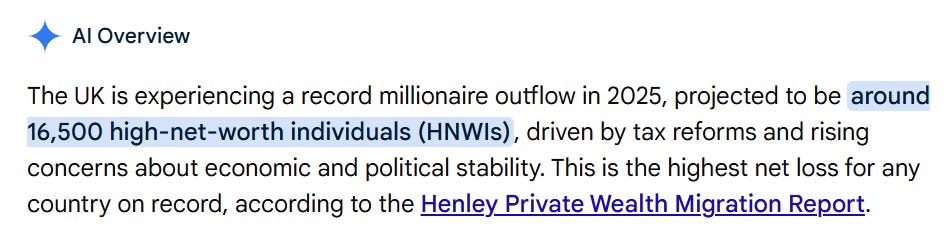

This is why proportionally the UK has the highest exiting of millionaires.

This is the highest net loss for any country on record.

Thinking this through logically… What happens if all the smart, innovative, rich f*ckers leave?

I’m no economics expert but it’s probably not a good thing.

Less jobs, less economic growth, all the fun stuff.

There’s some debate onto how many of these HNWIs are leaving, but purely from people I know in my industry, and myself, one of the reasons I’m considering leaving is due to the massive disincentive and high taxes on businesses in the UK.

So that’s the problem in a nutshell.

Yes it’s nuanced but the core issue is this.

Anyway, Georgism.

Created by Henry George, is an economic philosophy with the main idea of “when land value increases, the profit should go to the “community” not the individual.”

Now if someone said “profit should go to the community” to me out of context, I would think they are a commie and we all know how well that turns out.

But this is a bit more balanced.

Land Value Tax (LVT)

Land value tax is the idea that only the underlying value of the land is taxed, not the businesses/developments on top.

So this does not discourage any other business/economic developments. It just penalizes land hoarding.

The reason why this is different (and more of an issue) from capital hoarding/investing (which has similar tax rate elements but isn’t so much of an issue, in both my and Henry George’s opinion) is that land and capital is not the same thing, so it should not be taxed in the same way.

Land vs. Capital

George made a crucial distinction between capital and land.

Land is not created by human effort and is fixed in supply, unlike capital.

Therefore, taxing land doesn’t discourage its production (since it can’t be produced) and doesn’t create economic inefficiency.

AKA doesn’t f*ck over businesses or even investors, it just discourages raw land holding.

Imagine two identical empty plots of land:

Plot A is in rural farmland in buttf*ck nowhere.

Plot B is in central London.

Plot B is worth millions more, but not because the owner did anything to the LAND itself.

It’s valuable because of the city, infrastructure, and economy around it.

LVT essentially means:

You pay tax based on your land’s location value.

You pay $0 tax on any buildings or improvements you add.

The key: you can’t create more land, so taxing it doesn’t reduce supply or economic activity like taxing labor or business does.

Modern Day LVT Concepts

(We get a bit technical).

LVT would be a percentage not a flat rate.

The land’s value would be assessed (ignoring buildings).

You then pay a annual percentage of this based on this valuation (1-5%).

Only on the land value not on the property/business/frameworks built on top.

For Example: £500,000 plot. LVT of 2%:

Annual LVT: £10,000.

If you built a house on this, still £10,000.

If it’s empty, still £10,000.

Multiple Properties:

It doesn’t increase per property owned—each property is taxed independently based on its land value:

Person A: Owns 1 London lot worth £1 million = £20,000 tax (at 2%)

Person B: Owns 10 plots worth £100,000 each = £20,000 total tax (at 2%)

The Key Difference:

Current system: Building a £500k house increases your tax bill.

LVT: Building a £500k house = £0 tax increase. The penalty is on holding valuable land unproductively.

Speculation becomes expensive → less land hoarding → more land available → lower land prices.

So the whole idea is to reduce unproductive use of valuable land.

I tried to make this as specific to the UK’s housing problem and this is where we got, utilising AI to clarify exactly how this solves the renter/first time buyer problem, as so far to me it just seems like a more effective way to reduce income tax and replace it with a better method.

Solving UK’s Housing Problem

The UK Housing Problem as we discussed above, simplified:

High net worth individuals own hundreds or thousands of high value properties.

Current system: Low ongoing taxes (council tax is capped, also paid by the renter, no wealth tax).

They can hold properties, low administrative/energy costs, collect rent, wait for appreciation and benefit from improved tax advantages we discussed earlier.

This reduces supply for buyers → drives up prices and quality of overall housing decreases, and we are where we are right now in the UK.

How LVT Solves THIS Problem:

Current UK Example:

Own 1,000 UK/London properties worth £500k each = £500M portfolio.

Capital appreciation: £20-30M per year (4-6%) with ZERO tax hit (unrealised gains).

Rental income: £10-20M per year (taxed as a business/income generally).

Net position: Extremely profitable and incentivised to hoard.

With 2% LVT:

Same 1,000 properties worth £500k land value each.

Annual LVT: £10,000,000 (2% of £500M)

This £10M annual cost must come from:

Rental income (eats into profits).

OR selling properties to cover the tax.

LVT makes passive property hoarding unprofitable:

The wealthy investor bleeding £10M/year in LVT.

Can’t just sit on appreciating assets anymore with UNREALISED gains.

Must either maximize rental returns OR sell.

Selling 50 properties to reduce tax burden → more supply → lower prices.

Plus: LVT revenue could replace income tax, making it MORE attractive to earn through business/work rather than property speculation.

But.

If like me your next thought was “wouldn’t this 10M cost be passed down to the renter in the form of increased rents?”

So doesn’t this INCREASE not decreases rents?

Not quite.

Rental prices are set by landlords, who charge the most they can for the property they have. If they could charge £2,200/month instead of £1,800, they already would in 99% of cases.

They’re profit-maximizing.

Valid, no qualms with that.

Rent is set by supply/demand, NOT landlord costs.

Why LVT Doesn’t Get Passed to Tenants:

1. Can’t Reduce Supply (Unlike Other Goods)

Coffee tax → suppliers can make less coffee or exit market → reduce supply → price rises.

LVT → landlord can’t make land disappear → supply stays same → can’t push price up.

Land is perfectly inelastic - fixed supply.

2. Landlords Who Can’t Afford It Must SELL

This is crucial:

Wealthy investor with 1000 properties now paying £10M/year

Can’t increase rents (already at market max)

Can’t cover the £10M from rental income alone

Must sell 30-50 properties to reduce tax burden

Those 30-50 properties hit the market → supply increases

More supply → rents fall

3. Forces Development of Hoarded Land

Empty plots in prime locations now bleeding money.

Must be developed into housing → more rental units → more supply → lower rents.

The Paradox:

Yes, individual landlords face higher costs, BUT the system forces so much new supply onto the market that overall rents fall.

Economic Term: Tax incidence falls on whoever has inelastic supply. Land supply is perfectly inelastic, so landlords absorb 100% of the tax.

Let me know what you think about LVT and whether it’s a good or bad idea and specifically why, there’s a few counters I’m thinking about that I dive into below, this gets a bit technical so feel free to bounce.

Counter Opinions

A good post on why it’s a bad idea by Tom Forth, his 2 main issues (simplifying) are:

The valuation problem.

The centralisation problem.

Valuation problem crux: No land only models, hence valuing land separately would be very difficult (agree, true).

But it’s not like this hasn’t been done well elsewhere (Australia, Denmark, states in the US etc).

Just because it would be difficult, there are techniques that exist and if Australia and the US can do it successfully I think we can work it out. It’s a challenge but “fatal flaw” is incorrect.

Centralisation problem: “UK LVT proposals are national, would kill local democracy by replacing Council Tax”.

Valid point, but again it can be local anyway (US does this by state not federally).

The last argument is the fairness one, which I think is invalidated before we start based on the framing of this post, if tax rates were flat(er) then this would smooth (not solve) the housing problem anyway.

The fairness example: “£150k Blackpool house should pay similar local tax to £5M Westminster mansion because they use similar services.”

I think this is the least valid point based on;

Ignores economic value created by the location (AKA you couldn’t pay me to live in Blackpool).

Westminster land is worth £4M+ not because of similar services, but because of agglomeration effects - access to jobs, transport networks, economic activity. That value was created by business, community and infrastructure, not the landowner

Local services in expensive areas often DO cost more (staff wages, facility costs).

Local economics still work - Londoners get paid more, hence more HNWIs, hence prices increase.

Localised LVT solves most of this (centralisation problem).

Everything we’ve discussed above being a larger issue anyway.

Examples: Tom Forth’s System (Current/His Preference):

Blackpool: £2,000/year on £150k land = 1.33% rate

Westminster: £2,000/year on £5M land = 0.04% rate

Result: Westminster super cheap to hold → encourages hoarding

LVT at 2% rate:

Blackpool: £3,000/year (2% of £150k)

Westminster: £100,000/year (2% of £5M)

Result: Westminster expensive to hold → forces development OR sale

Key difference:

Flat tax (Forth’s idea): Both pay SAME AMOUNT → backwards incentives

LVT: Both pay SAME PERCENTAGE → correct incentives

This is why it needs a percentage value not a flat rate.

OK, long technical one but hopefully an interesting concept.

Thanks for reading, open to thoughts and ideas.

![r/dataisbeautiful - [OC] Salaries vs House prices in UK r/dataisbeautiful - [OC] Salaries vs House prices in UK](https://substackcdn.com/image/fetch/$s_!XJ_p!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ffd222fd4-d23c-45c8-a6f7-34dd6acd2b1c_432x288.png)