Human Nature Styles For Success | 100/1 Odds vs 1000/1.

The Difference Between 1% & 0.1% in Success, Sports & Markets.

Humans are terrible at judging tail events.

We also have loss aversion tendencies that make losing continuously more painful than the equal proportion of success.

Here’s an example.

In trading there’s multiple very powerful strategies that involve taking small daily losses but waiting for large gains (all at once).

Humans in general are terrible at this strategy, and knowing that you are this way, is actually a really important way to mitigate the issues.

I was speaking with a trader about this concept today and talking about how a friend of mine who’s earning through tournament poker basically also has this issue.

For anyone who doesn’t know, the pay-out structures in tournament poker are very top heavy, meaning if you are in a tournament with an entry of $109 ($9 usually the fee to enter) and there’s 1,000 players in this tournament, the prize pool will be roughly split in the proportions below;

In tournaments with around 1,000 players, this 28% 1st position drops even further down to 20/15%.

But in short, the top-heaviness of this method is crazy high, meaning if you play very well but get unlucky, you won’t make much money, ever.

So it’s a mix of luck + skill, which I think everyone knows poker is nowadays.

The issue of this earning style is the “mode” earnings throughout a week or month of playing 200+ tournament is negative (whatever the entry fee was).

But the spikes are positive when you “run well”.

Essentially meaning that you lose small chunks often, win medium chunks occasionally and win massive amounts once or twice a month (depending on how many tournaments you play on a weekly/monthly basis).

That’s a really big mind f*ck.

It’s the same reason why if you can create a tail-event type strategy in the markets (whatever markets they are, financial, sports, business even), you’ll earn extremely well.

The problem is, from a human nature perspective it’s really tough to do.

To show up everyday, lose, do it again, lose, and on and on. Especially if you are playing in the 99 losing days for every 1 winning day.

The Difference Between 100/1 & 1000/1 Odds

Another difficult concept for humans to understand is the difference between 1% and 0.1% or 100/1 vs 1000/1.

Obviously in a true odds sense, these events happen 1 in every 100 times (and 1000 times respectively), but when weighted against how often they are perceived to happen, they can get a bit blurred.

For example, here’s some questions from the sporting world (apologies to any non-sports people, but sports analytics is my industry so that’s why they are all sports related).

What’s the probability of a half court shot being made in the NBA? (With no other info).

What about a hole in one in a professional golf tournament?

Most people say somewhere between 50/1 and 1000/1 for these events.

Interestingly they are way more extreme, which is kind of my entire point.

To start, a half court shot in basketball, people thought was more likely, this is down to confirmation bias. When someone makes one, it does the rounds on social media, everyone talks about it for days. When someone misses, no one views or cares. As a result;

Interestingly, people did not get anywhere near on the golf question in entirely the wrong direction.

People thought this happened far less frequently than it actually does.

This was likely a thought-process issue, because the actually probability of any one shot going in is pretty low (about 2,500/1 for pros).

But when you have 140 pros and 4 rounds of 18 holes… Suddenly your 1 in 2500 happens roughly every other tournament! Or 50% of the time!

This is actually something you can bet on that’s reflected in the markets (this example is slightly less likely due to the course conditions, but you can see, pretty close to evens).

This is all well and good, maybe interesting to some, but who care and why?

Mainly it’s important to understand it backwards, so 1000/1 events, being priced at 100/1.

For example this is common in the options market, where prices may look attractive at essentially 100/1 odds, whereas in reality these events are beyond 200 and even 1000/1 in most cases.

It’s more common in betting markets though, and it’s far more extreme!

To take a live example in cricket.

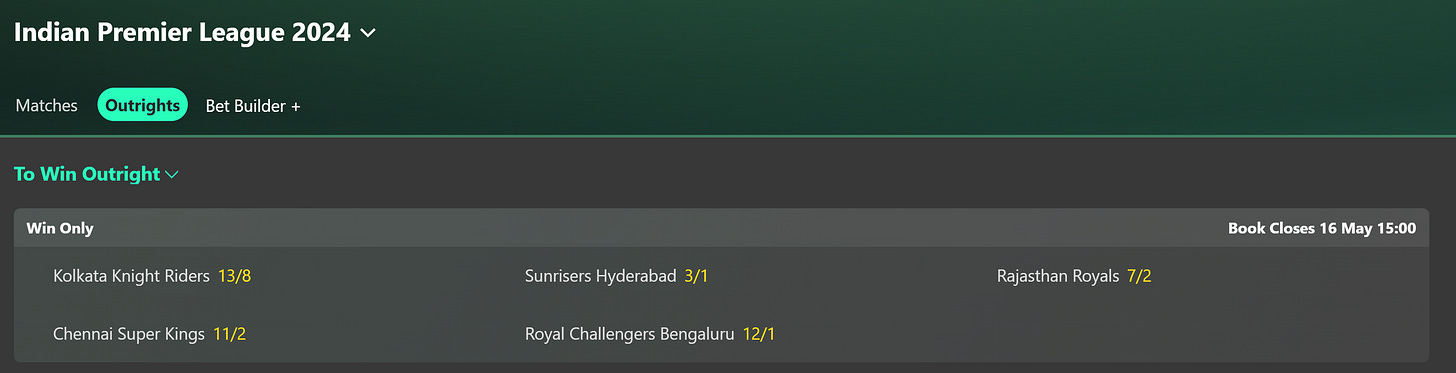

These are the odds for the IPL 2024 as of today (15th May 2024).

The team I want to outline is the last team which I’ll call RCB at 12/1 odds.

In reality, for this team to win alot has to go right, (below is the exact maths for any nerds, with American odds).

Win last game - currently slight favourites (-125).

Win this game by more than 18 runs, this changes the probability to closer to (+200).

Win eliminator (-110).

Win “Semi final” (-110).

Win “Final” (-110).

I’ve simplified the odds to make this easy to understand but all 4 of these things happening gives you odds of roughly; 20/1.

Which is a long way from 12/1.

These margins only increase between true-odds and offered-odds in sports betting in most cases.

This is so common it’s actually called the long-shot bias.

It tends to refer to specific individual games, but applies to futures as well.

Advantages can be found where they cross back over, especially if 3 criteria are met;

In the longer term things are correlated.

Variance can get extreme.

Timeline is long.

Lots of unknowns or mis-information.

When these things can be combined, 1000/1’s can be priced at 100 in multiple different areas. The only issue is, can you bet these enough times to make it likely to succeed?