So What If You Fail? The Survival Life Task

A Thought process before taking immense amounts of risk.

So what if you fail?

What’s the actual worse thing that could happen.

I’ve failed so many times, even more recently when I should be “older and wiser” I’ve made some pretty stupid mistakes.

Not just small ones either, we’re talking 6 figure blunders.

Looking back it’s so dumb.

But looking back at the 5 or so biggest mistakes over the past decade of business, they seem to have one clear correlation.

One recurring theme, regardless of niche or project or industry.

That was being in a rush.

Trying to hack or cut corners or make money easily.

This being in a rush comes from a place of fear as well.

Fear of failure.

If I’ve spent 2 weeks doing something and failed, no biggie.

If I’ve spent 2 years though, that does suck, that hurts the ego.

But there’s also the flip side.

I’m launching something big, it’s taking an incredible amount of money, effort and time.

It’s built right.

I’m not in a rush.

But I still have to eat.

So you have to have “runway”

The amount of time you can work on something before you run out of money.

So you have runway, call it 12 months.

But growth takes time.

Even if you succeed you need more cash.

Success or failure both take cash-flow.

Failure - This is obvious.

When something is losing money you have to do something different, invest more, start over, work it out. They all take cash.

But success.

That’s also a cash-flow killer.

You have to order more inventory, quicker, with massive lag-times being ordered + being paid, you have to re-order whilst another batch is “in transport”….

And what happens if sales decrease and you’re stuck with 1,000 non selling units?

Successful businesses also die through cash flow issues as much as unsuccessful ones.

The stress is real.

But back to my point, “so what if you actually fail?”

Actually think it through.

Think through the downsides, the back-up plans….

How much different would your life actually be vs having not tried?

I call this the survival vs epic life task.

I did not create this concept, but it’s something I think about when I’m about to take immense amounts of risk (the coming 8-12 months or so).

Where there’s a real possibility things don’t work, investing all your savings into something that explodes.

The core idea is you create 5 versions of your life.

Survival.

Basic.

Good.

Great.

Epic.

With what the absolute minimum amounts look like in each “life” at that level.

I think the most powerful ones are the survival and basic lives.

Great and epic are powerful for another reason which we’ll get onto later.

These life-based tasks involve writing every cost you’d have/want at every level of your life.

So in the survival stage it’s the absolute minimum, food+shelter.

In the basic life it’s this + the things you value the most (gym, phone, internet, slightly less dodgy living arrangement) and so on.

The idea is to see how low the bar is for you in these 2 levels, and how close you might actually be to the great or epic lives with everything YOU personally want.

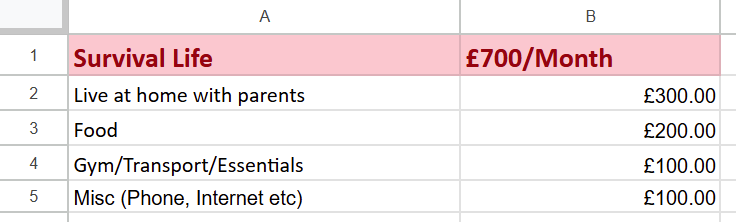

Here’s my survival life for some context:

If everything hit zero, this is what my survival life looks like.

What’s interesting is I created this doc back in 2017.

So even with how things have changed over the past almost decade, the concept remains absolutely rock solid.

What’s the worst thing that could happen?

Let’s work through, I blow up all contacts, friends and businesses.

I plow all savings and investments into the businesses that don’t work.

So we’re at ground zero + debt of X amount.

Then what?

After being pretty bummed out for a few weeks I’d meander my way back to Cardiff and pay my parents £300/month to live at home.

You might think I’m very lucky to have parents that would let me live at home / even possible to come back home with a wife, a cat and 2 rabbits…. That’s a funny image… But a valid point.

Your survival level will be different, if you have no family left that you could live with for 2 months then adjust your survival life thresholds.

But in this survival life that is it.

So now I need to get £700/month.

What I’d do to get this amount is probably sell anything of value to start and at the same time is create an offer that’s free to deliver but has high value.

For me personally this would be a local service business of some sort.

I’d then offer the first one for free to get customers.

Nothing fancy yet.

Based on the skillset I have and the understanding of sales, to get back to £2,000+ a month would take probably a few weeks.

I know to some that might seem crazy but you have to remember this would be rock bottom.

<Mini rant> What I’ve never understood is why people can be in a sh*t situation and just carry on living life like nothing is wrong. Why watch TV if you are living with your parents at 25? Why spend money going out if you hate your job so much you physically shudder at the thought of going in on Monday? Bizarre to me. <Mini rant concluded>

In other words, have some AGENCY.

Take some action.

After a couple months I’d upgrade my lifestyle to the basic life.

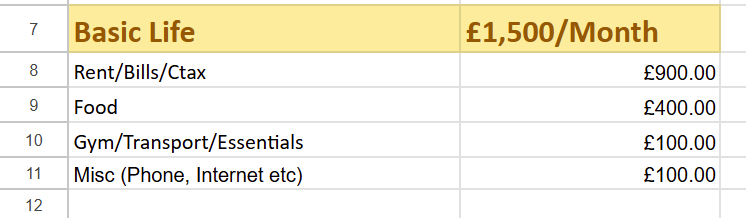

This is what my basic life looks like.

This is how I lived for about 3 years whilst building the businesses.

It’s actually not even that bad, although in 2025 money, this would likely need to be tweaked.

The idea here is you are not broke, but you want to live off the bare minimum and re-invest everything else. Time + Money + Energy.

You need to be extreme.

Say no to everything to grow and proceed.

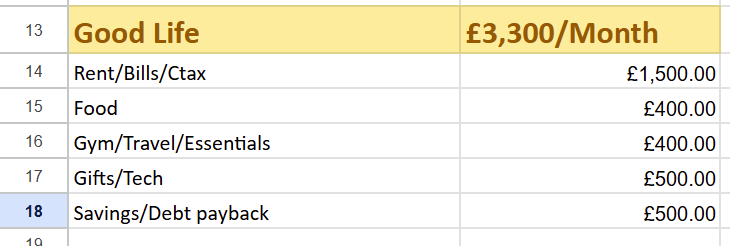

Doing this everyday you will quickly reach “the good life”.

Which might be the perfect name of anything ever.

The good life is the level I despise.

It’s comfort without purpose.

It’s where most people live their lives for decades.

Yours will look different but write every single cost you’d have to build this “good life”

Once you’ve completed this section you can go onto the 2 top options.

The Great & Epic Life

Depending on what you personally like, you need to get into what you would do/have if money was almost no object, but think through this on a day to day basis.

My versions are below and although they’ve changed since writing this, you get the idea.

From here you have 3 really important decisions/tasks.

The first is to create your “action threshold” at each level.

Let’s say I’m living the epic life but I lose all my income for whatever reason.

From here I probably don’t need to jump all the way down to survival but I do need to maybe jump down to great, depending on 3 things;

Runway of savings/monies.

Personal risk tolerance.

Confidence/time to increase income.

These will be custom to all individuals but the idea is let’s assume you had £150,000 in savings/liquid cash/assets.

That’s 10 months at living the epic life.

Chances are you wouldn’t want to just live this life for 10 months and then go straight down to survival.

Instead you’d gauge your risk tolerance and confidence/time to increase income.

From here, you’d either go down to great or good and suddenly instead of 10 months runway you have 22 months or 45 months!

That not only takes the stress off, but it allows you to avoid BEING IN A RUSH!

This helps you avoid stress when making decisions containing immense risk.

Simply decide when you will downgrade if situations do not change.

Make it action based and absolute.

If savings decrease to £X I’ll simply go down to good life until earnings increase to X.

I think people make these financial decisions emotionally, when they really are just logical decisions.

There’s obviously a ton of ego involved in money and earning related things, but that’s an issue for another day.

It’s a simple way of saying, downgrade your lifestyle before you need to and dissolve the ego.

Not easy but simple.

But another key to this process is it works on the upside.

The Upside.

This is what I originally did this task for.

In the year before I did this task (2016) I made £24,880.

Yes, I track personal income every month.

Yes the ADHD is strong.

But it helps reframe things.

If my EPIC life, the life that has everything I’ve ever wanted is only £15k a month (that’s after tax mind).

Then what actions do I have to take to achieve this.

And work backwards.

So if I have an agency that sells something for £1k/month and we have £500/profit per month on that.

We need to get to £30k/month profit (due to taxes) to get to £15k/month net.

That’s £60k/month revenue, that’s 60 sales per month.

That’s 2 a day.

How do I make 2 sales a day is far easier than how do I create the best life I can imagine.

So in summary.

Take more risk, the downside is not as low as you think.

Build the ultimate upside, it might be closer than you think.

Absolutely love this man! I think many people just think in binaries, I know I do, they calculate the worst situation(survival) and the best scenario(epic life) but not the in between steps. Great reframe to get you through those chapters.

Also on the mini rant - I would kindly refer to the Region Beta paradox. For most people they need fall into a worse situation before having the activation energy to make a change. And I can go on about living standards in the developed world giving almost everyone a comfortable situation but I digress!