The Broken System: Why Inheritance Happens at Exactly the Wrong Time

Die with Zero meets income vs your parent's assets

I’ve been meaning to write a post on Die with Zero and the concepts, but wanted to relate it back to a specific example which is mentioned here.

The Problem

An example we’ll use here is one from a podcast where they discussed an older woman who lives in a house that she bought in, say 1975, for 3 tuppence and a turnip, that is now worth £3,000,000 (London, obviously).

You can use relative numbers, the concepts will work all the same.

But she has no income, limited retirement funds and as a result lives fairly poorly, circa £20k a year. 2 kids.

To make matters worse, her children, albeit less poorly, don’t have it great.

Let’s say normal jobs, 30-70k/year range, maybe higher if they are still in London.

Nothing wrong with all of this, I think most people have this similar structure, albeit likely lower numbers.

But, things are broken.

Going from £30k —> £70k a year is such a massive jump in life quality.

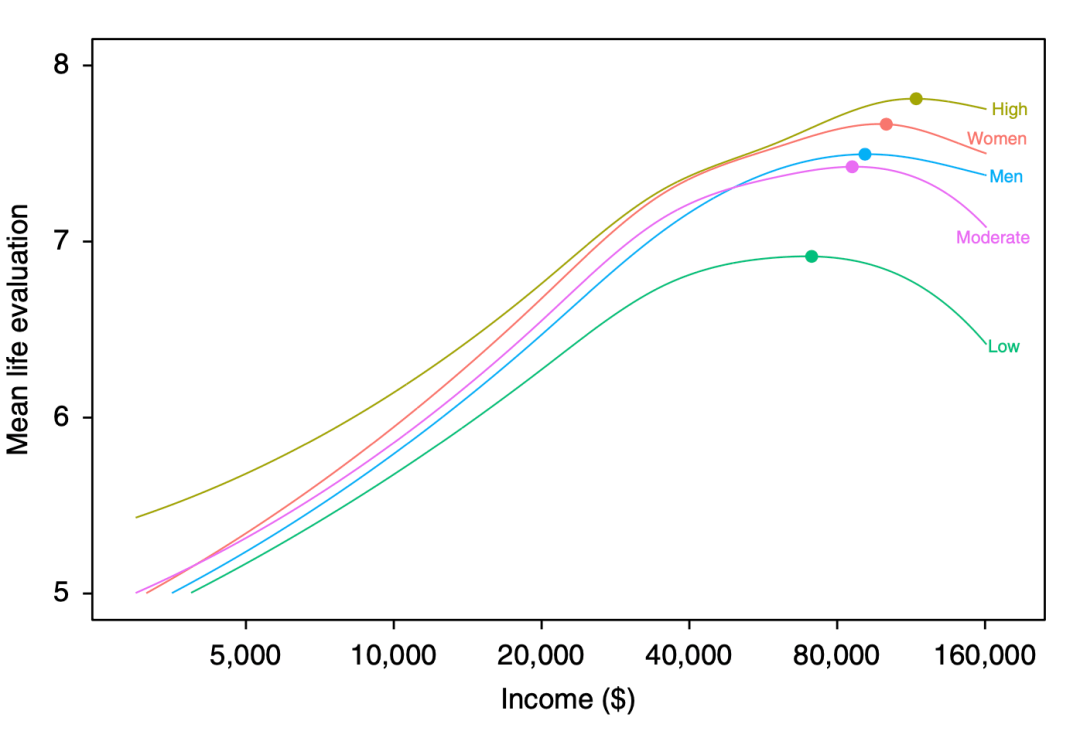

Even all the happiness research shows a plateau around this £70k/year mark vs steep increases in happiness per income bracket prior.

In short from these studies:

A large peer-reviewed study (1.7 million people worldwide) found that happiness/life satisfaction peaks around $95,000 annual income and doesn’t meaningfully increase beyond that.

Emotional well-being maxes out even lower, around $60,000-$75,000.

This all makes sense as living on £15k vs £30k would be substantially different.

So having: 3 people below the “peak happiness income level” yet having £3,000,000 of “assets”….. Just because “that’s how it’s done” seems (and is) mental.

Both the children and the mother are living sub-optimally just based on “social norms”.

Most of the older generation, such as parents (of friends and family that I know) are wealthy but not rich.

They own a £750,000 house outright.

Maybe more than 1 car.

Maybe a bunch of stocks, ISA’s, investments and so on.

But act like they are on the poverty line.

Yet, they shop at Lidl (albeit nothing wrong with that) and penny pinch on parking or chicken or will spend an extra 15 minutes driving to save £5 on fuel….

Essentially the difference between wealth and income.

Net worth and earnings.

Die with Zero

Die with zero for anyone unfamiliar is a book that basically centralises on one concept around of avoiding over-saving and under-living.

It’s something I think we all inherently know but it’s explained very well and concisely, worth a read in full.

I tried to distill the whole book into a couple of sentences:

Don’t work more than you want or need to, to over-save for things you do not want or need. Invest in experiences over “stuff” and borrow from your future self.

Some parts sound quite similar to the line in fight club:

Albeit I think most people replace this with work now.

The key part for this post though is “borrow from your future self”.

Why Inheritance is Backwards

This structure is caused by the underlying issue outlined in die with zero.

Over-saving (in the form of net worth).

Giving at the wrong time.

Not understanding the differences between savings and earnings.

It’s super common.

Inheritance is a broken system because it doesn’t benefit the parties involved at the correct time, not from a tax point of view or anything like that, purely from an actual die-with-zero point.

One of the key points in die with zero is to basically borrow from your future self.

Kind of like how if I could lend my 15 year old self £1,000, how far that would have gone, or my 22 year old self £10,000.

The author talks about this “borrow from your future self” idea in regards to experiences.

To optimise your life for fulfilment and happiness.

“Doing shit you want to do, when you want to do it”.

100% agree with that.

But let’s assume we’re only talking about it from the economics point of view.

£10,000 to you today vs 10 years ago will always be proportionally different.

It’s kind of like when you were a kid and £100 seemed like an incredible amount of money.

Even when you are a teenager and you make £500, it’s probably the richest you will ever feel.

But when you are older this continues in scale, so when we are 30-40-50-60, you likely (hopefully) won’t “need” the £10k or even the £100k.

And taking this to it’s logical extreme, the day before you die you won’t need ANYTHING in the bank, whether that’s £3M, £100M or £500.

On a less extreme level, most people won’t be starting businesses at 60 or 70 or travelling around the world for an entire year.

The problem is, that’s the exact age at which most people (if they are lucky enough), will get it, usually through inheritance.

This is broken for EVERYONE involved.

One of the best nuggets I like in die with zero is the idea around when to give your children/whoever you want to get your wealth when you die.

Talking in terms of kids is easier.

Because when you think it through it’s so backwards.

It’s the same as our borrow from your future self idea, instead of 10 or 20 years, it’s a generation.

We create wealth to give to our children when we die?

When they need it the least, usually, assuming we have a good innings, when they are already 50+, 60+ in a lot of cases.

Imagine thinking giving your kids wealth when they are already retired and cannot enjoy it properly a good idea.

Yet 99% of people do this.

Maybe more.

It’s also so backwards as you can’t even see your kids or friends or charities enjoy it.

Personally I’d rather give it away earlier and see the benefits firsthand.

So all parties are worse off.

The kids get it after they really would have needed it and the giver themselves is dead so they don’t get to see the good it does.

Such a broken idea, like so many others related to this concept.

One really easy thought experiment for this.

Assuming you are planning to give you kid(s) some chunk of inheritance, let’s say £300,000.

Wouldn’t it be better to give it to them now and have them live in a £800,000 house, versus living in a £200,000 or 300,000 house?

The gap is probably even larger than this given how far a £300k+ deposit would go.

But hopefully that illustrates the point.

They get to benefit 20 or 30 years earlier, without it impacting your life in the slightest.

How much better is THEIR quality of life and all you’ve done is given (what you were going to give them) earlier.

Everyone benefits.

Let’s Run The Numbers

Let’s go back to our London mum’s “issue”.

£3M house, no income, “poor” lifestyle.

Let’s also say that the £3M house never goes up in value again and this individual had 2 children.

In “X” number of years (when RIP), the “kids” get (call it £1.25M after inheritance tax, likely 1.5M as it’ll probably be set-up in a trust anyway) of inheritance money.

That means in our super extreme example, they could (literally) not work (or work and party up the rest with crazy experiences, travel, everything you want to do whilst you can do it, such as backpacking when 20 not 45 for example) and have a net-loss of income of £30k a year.

Literally 30k a year of debt…. For 20 or 30 YEARS.

Call it 30 years, let’s say mum takes her vitamins and lives to 90. And you had an “excess” life for 30 years between 30-60.

Come inheritance, you now have £1.25M minus £30k x30years = £900,000 = £325k in the bank AND in that time you actually lived.

But no one would do that….

If you did you’d be seen as a crazy person, without a plan or it would somehow seem morbid.

Option 2

You still end up with 1.25M at 60.

But instead you grinded it out, worked up, got up to 50/70/100/140k a year.

Income tax gets you, but you save up, made “smart” decisions and that 30-60 timescale you actually created £1M of net-worth.

Most of which is now tied up in your house.

Now mum croaks at 90 again and you have 2.25M net worth.

Now what?

Are you going to go backpacking at 60?

You can definitely retire.

You literally doubled your net worth overnight.

But the health is probably not great.

I can’t imagine skiing is on the menu either.

What you WANT to do is probably more relaxing (and cheaper) anyway.

SO THE CYCLE CONTINUES.

A Personal Example

On a personal level, when I was starting businesses in 2012-2015, even 2018 range, before getting the profits up from the existing businesses, like any start-up I needed cash.

I had zerooooo money.

Instead of getting cash from the bank of mum & dad, I just grinded a bit, got some loans and short-term financing options (at silly rates) and grew at a slower rate.

Long story short, it worked out fine but could have been a lot better, faster and more effective.

2019 onwards things started to go alright for me, scaling up, learning skills, making some disposable income etc.

This is where these concepts merge.

The idea of die with zero and “traditional wealth building”.

From here (albeit I didn’t do it) I could have used this to build “traditional-wealth” and taken the traditional route by buying property, savings, index funds etc, but especially property.

Instead I wanted to re-invest the profits into other ventures, businesses, bankrolls and so on.

Some of which worked, others didn’t.

The important point is that nowadays I don’t really “need” the money as much as before, albeit scaling would be faster.

The Solution

I also re-read die with zero this week to try get this idea across better.

Another good concept related to all this is the idea around working the optimal amount and time-bucketing - essentially timing your experiences (do things now you won’t be able to do in your 50s, almost regardless of costs).

It is of course far more nuanced but the core concept is pretty simple to understand.

Optimise your life for positive experiences not saving money.

What if I run out of money?

The pushback is always “what about X” “What if X goes wrong” “What if I run out of money”

The main rebuttal to this in the book is to assign what is yours and what is “theirs” or what you are going to give away?

Let’s say you £1M of net worth and (is usually the case) people do not spend down the principal.

So it will continue growing even when expenses decrease.

There’s so many ideas in this book but I’ll leave it at that for now.

Cheers.