Information Asymmetry

The "skill" that makes everything else unnecessary.

In a previous post I introduced the idea of information asymmetry.

A very short recap, go read the other one first if you haven’t already for a better understanding.

The Monty Hall Problem is not a maths problem about probability and switching.

It’s a problem around information asymmetry.

The host knows something you don’t, they communicate this, hence giving you a probabilistic advantage.

This concept led me down a rabbit hole I hadn’t heard of before.

Information Asymmetry

If you want to get better results at anything, you have 2 options.

You can build up either skills, try to build an edge(s), “grind” or you can create information asymmetry.

This information asymmetry idea applies to any professional and personal area of life and can be as simple as knowing something the other person “doesn’t-know-you-know” to literal illegal shit and fraud.

In dating/sex, knowing what someone is looking for, their hobbies, interests etc. gives you a massive edge vs going in without this info.

This also works just knowing WHO someone is, you can phrase your conversion to what you know they like.

This is actually just sales in a nutshell.

Another direct example would be in silent auctions, knowing how much someone is going to bid before they do so, obviously is a very direct example of information asymmetry as you can go £1 above and win instead of potentially thousands above if you wanted to make sure.

But I wanted to think of an example that’s a little more nuanced as this whole idea is best explained in multiple examples.

Here’s one.

Health/Insurance data

If you take care of your health and have multiple blood tests, genetic tests, even full genome sequencing as well as daily health tracking data (whoop bands, oura rings, apple watches), chances are you are pretty clued in on your health.

So imagine if you knew you might be pretty prone to a certain disease or illness.

Health insurers know alot about you, but they don’t know your full genetic sequence (yet). As a result, if you knew something that would change your health-insurance premiums/rates, would you tell them?

This is a very direct form of personal information asymmetry.

Usually this is the opposite way around based on all the data and actuary info that insurance companies have.

But in a very granular personal situation, they do not know this (yet).

Ethical line, and one you should probably be conscious of if your data is then sold to health insurance companies….

But assuming that doesn’t happen, considering you personally have gone out of your way, paid for and proactively done these tests/screenings etc, would you let them know?

Most like increasing your premiums in the process.

Personally my answer would be no, but not just for the obvious (less cost) reason.

Instead it would be purely from a logical standpoint, if I'm at a higher risk of disease X and lower risk of disease Y, I can take action (lifestyle, training, diet, supplementation) to decrease my risk of disease X further anyway.

But this pro-active prevention approach is not yet baked properly into insurance protocols.

Interesting one to think through that isn’t just related to money and professional stuff that I usually talk about.

Money & Professional Stuff Information Asymmetry

Simplifying money and professional projects into 2 to-do actions.

Create Skills - Ideally edges, as discussed at length previously on this site.

Create information asymmetry.

For me this acts as a really clear and easy to understand strategy for success.

Build more, better, relevant skills.

Find or create information advantages.

Simple.

Given the choice as well, always choose information asymmetry.

The funny part is that even if you have extreme skills, super high EQ & IQ, resources and all the advantages, you lose to creative information asymmetry.

Here’s a few examples.

The Greatest Investor of Our Time

The most obvious one that comes to mind as an extreme version of information asymmetry is insider trading.

There’s a reason why Nancy Pelosi is the greatest trader of all time, and it’s not to do with skillsets.

It’s the same reason why insider trading is super illegal.

There’s now also a Pelosi stock tracker with over a million followers on Twitter for this exact reason.

Another similar example would be crypto influencers.

If they have weight and a large following, all you need to do is know when they post, get AI tools to “watch” the video and give you the angles within 20-30 seconds. And front-run the angles.

Again, there’s obviously some ethics involves when you are talking about some of the trash that these people promote but that’s up to you.

At the end of the day this concept is what people do for the Fed interviews and announcements with billions of dollars, monitoring every word as it is spoken and making trades milliseconds after this happens.

Poker - 2 Versions of Asymmetrical Information

Another easy example to understand is in poker land.

The most extreme version is borderline fraud.

You can be the best player in the world but if the other player knows your cards its all for nothing.

If your in a fixed game, same thing, you are done.

But assuming that’s not that common in the regulated/online world and you have some kind of morals, there’s another more real version.

This is to know exactly what someone has done in every similar situation they’ve been in.

So you have data on what a player is likely-to-do given the current circumstances.

This is a massive asymmetrical informational advantage that is very possible to build with some determination and just putting in the hours.

It also gets multiplied in effectiveness the more people are added to this database/system.

If there’s 500 regular strong players in your field and you have data on half of them, you can leverage this in important, high-impact spots.

Leading to better decision making in very leveraged situations, leading to better earnings throughout.

My First Real Informational Asymmetry

In a personal, real example, years ago I had a massive information asymmetry, albeit I didn’t call it this or really know how extreme it was at the time.

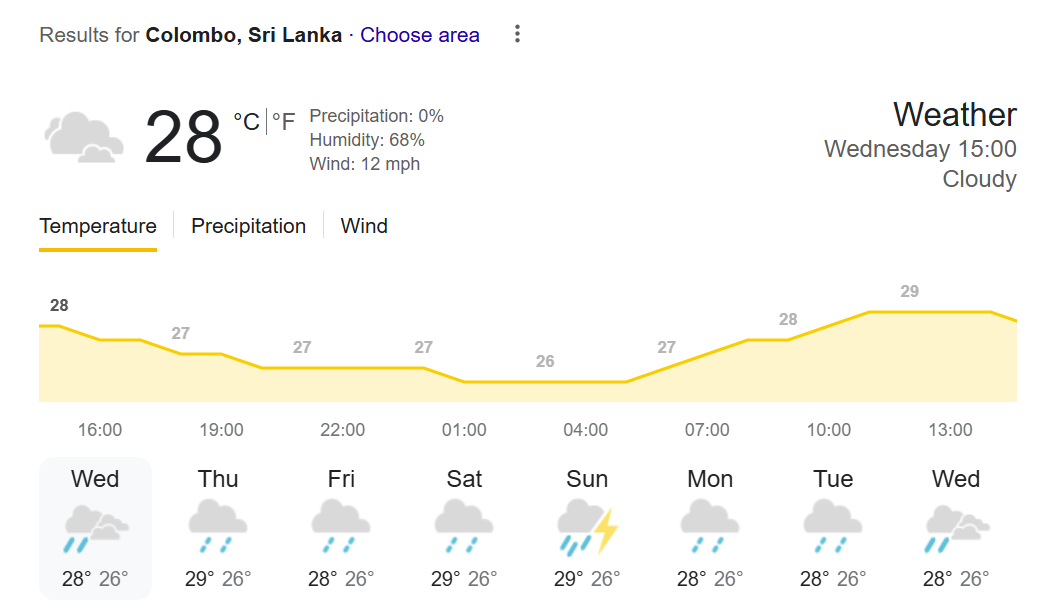

The idea was simple - weather in cricket.

More specifically, how to use this in my favour.

So for anyone who doesn’t know, there’s a type of cricket (the long ass one that lasts days) where you can bet on the result being a draw.

To keep things simple, if it rains, they don’t play, if they don’t play, they draw.

It’s more nuanced but not really.

Even cleaner version: in some types of cricket, if it rains they don’t play, hence the result is determined by the weather directly.

Everyone already knows this, definitely not an informational edge or asymmetry.

But.

Which weather site(s) sportsbook use to adjust the odds or create the lines is important to know.

Meaning those actual weather-websites help make the line itself….

That’s a key bit of info, as last time I checked weather sites weren’t oddsmakers and these sites really aren’t great at predicting weather events, especially multiple days out (considering our cricket game lasts 5 days).

As a result what tended to (less so nowadays) happen is that sportsbooks over-adjust weather, and especially in some cases (Sri Lanka for example) it’s always raining but also never-raining, and hence massive value (40-50% edges) just because you knew which weather sites were “correct”.

So “raining all week” = probably about 5 hours of heavy rain across 5 days…. Not the same thing.

*There was also some specific knowledge here, that in-general cricket draw pricing is mispriced (the short version: less games are draws nowadays, so prices should always be larger than they are).

**You can also layer in cricket pitches/stadiums that historically have quicker games (tough pitches, more wickets etc.) but you don’t even need to go that deep here.

So, in short, the process was:

Everyone thought it was going to rain more than it was.

Due to sportsbooks using poor weather sites.

By knowing which sites were more accurate.

Versus which sites were used by sportsbooks.

Created an edge of 40%.

The key is in the simplicity.

Zero code, zero player modelling or complex algorithms were needed to come up with this, it was literally just “it’s not gonna rain as much as they think”.

I even hired a dude on Upwork for a week near the stadium to text me weather updates, that’s the super lazy version of the above but that’s a story for another day.

Creating asymmetrical information is your biggest (and most obvious) potential edge.

In an SEO example, if you know exactly how to actually rank a website and can do so every single time, that’s asymmetrical information because 99% of people (including SEO agencies) do not know how to do this.

It might be a simple, slightly boring example but it’s a clear one.

The reason why trading or sports/betting is a better example is it’s very clear, granular and quick to get correct feedback. AKA did you win?

If you have custom data or key information (injuries for example before they are publicly available), nothing else matters.

If you know the best player on a team is out before the market does, you don’t need to know anything else about the teams, players or even sport - you just bet the opposition.

Unlike investing, this is not insider info or illegal, unless your playing in the game? Then I think it’s illegal to bet on your own matches…

Either way the asymmetry is massive in these spots.

<If anyone has this info please call me>.

Anyway.

When the market finds this information out, the line will move.

Then if you really want you can “sell out” the position, hedge or even just let a very good bet ride.

This is the “buy the hype, sell the news” type concept in investing, albeit you already know whether it’s real hype or not as you have this informational advantage.

Another example (that’s a real story from someone) is seeing a tennis player in a nightclub the day before a tournament starts…

Can’t imagine that’s good for performance, and you can always buy them a bottle to make sure.

Although all these information asymmetry examples are obvious and extreme there’s more nuanced ones too.

Getting your hands on good/custom datasets that other bettors/traders/businesses don’t use. That’s an informational advantage (depending how you use it).

On a individual smaller scale, understanding where the company you work for or your boss/manager is in their current lifecycle. Whether you have leverage or not.

Based on experience there’s people I’ve worked with that have leverage over me, meaning if they priced twice as much I’d have to just say yes, there’s others where if they asked for a 1% raise I’d say no, it comes down to value and leverage.

A company about to IPO, a start-up raising money, or even on a very small scale a team member in a company that is struggling to hire good talent.

These are all dynamic changes that result from informational asymmetry.

When you have a job, if you are a valued member of the team, you could always be thinking “how much fuckery would it be to replace me?”

This changes your positioning, so if you approach asking for a 30% raise, you are coming from a position of strength not weakness.

Of course it needs to be valid, earned, you need to add value already etc etc but from a pure positioning standpoint, it’s easier to do if you know that a company cannot afford to lose another person.

Creating Informational Asymmetry

The more difficult part.

If you are with me that info asymmetry is a bit of a goldmine, the next logical step is how do I build this.

This concept runs all the way back to creating an edge in any project or business you are working on. The whole concept of which was explained in one of the first posts on this site.

The very short version - create value by doing all the work upfront, to build something that enables you to benefit and earn on repeat.

How to create informational asymmetry?

First realise they exist fucking everywhere.

The more creatively you think, the more you will see.

Narrow down what area you are going to look for them in - professional, personal, health, relationships.

Next narrow down your specific skills related to the angle.

Although these aren’t essential, having some context about the project is valuable to speed up the process.

Next create a desired timeline/timescale - most of the examples used in this post are very short term timelines because they are easier to explain but information asymmetry can be used/created/benefitted from for years or decades.

This is more of a desired timeline rather than a concrete one.

Do I want to earn through my info asymmetry within a day, week, decade, the timeline is up to you but just define it.

Think creatively and list every detail, every input that impacts, effects or is related to your specific project.

The more granular and niche the better.

I’m talking things as deep as the following (if we are thinking about the cricket angle);

Weather - mentioned earlier.

Travel - where are people coming from.

Pitch - what did it do last time, was it too much/little?

Grounds staff - do I know anyone who knows them.

Players - Who might be injured, who’s posting Instagram stories in-da-club.

Incentives - Are there incentives or disincentives at play.

Covid - this was a good one, who’s out with covid/near-covid points.

There’s so many but the more granular (and random) you can get the better.

You can also use 2 tools to think about this.

Inversion thinking - what’s the worst case look like. I thought it was going to rain for all 5 days every single day and it turns out it’s being played in a different fucking continent. Literally….. Not speaking from experience….

BEST CASE thinking - Working backwards from best case thinking. “Best case is I own the stadium and pitch this match is being played on and I know every single player personally to ask them who’s playing, who’s injured etc). Realistically could I know 1 person and 1 scout in the building…. Probably.

Another idea is to add in second order effects.

So another (cricket weather again sorry) example of a good second order effect was informational edges through a massive fuck off storm coming through the UK.

Everyone knew it was coming, everyone knew it was going to suck and not many results were going to happen.

But people didn’t realise the scale because there were still some unknowns, such as whether it would be bad for say 2 days instead of 3.

If it’s 2 days you might get some results in the cricket.

If it’s 3 days then it’s borderline impossible to get any (hence betting our draw option is a good idea at any price).

What people didn’t realise is that individually this didn’t matter but because this was a UK wide storm, if it’s really bad weather in Bristol, it’s probably going to be very bad in Cardiff, and Taunton and London and Southampton…

So if one game draws, they all do.

So now we’re correlating results but versus one outcome (shit gonna rain a lot).

As a result, something like 37/1 odds on a 60%ish probability of all matches being draws.

Not bad.

A bet of £500 has an EV of: £10,900.

Still to this day probably the best EV bet I’ve ever made.

Zero cricket modelling, zero stats knowledge needed, just a bit of creativity and specific understanding of situations.

It also resulted in this market getting removed, which is why I’m fine to talk about it publicly now.

Hopefully an interesting concept, let me know any creative information asymmetry ideas.

Cheers.

Tom.

I feel like this is also why people tell you to do what you enjoy/have experience in before jumping into something you know nothing about. It can be tempting to jump into the trendy, sexy new thing but you forget about your asymmetry.

Worked in a McDonalds before? Well lean into hospitality marketing: not just marketing for car companies cause its sexy.

Enjoy reading the latest news on tech gadgets? Start a tech review YouTube channel: not a channel about music just cause its popping off.

Although its not exactly asymmetric (i.e. lots of people have worked in hospitality before, you are not unique in that) but you don't want the asymmetry to be against you. Why start something new you know NOTHING about, in which case almost everyone else will have better odds than you. Inversion thinking I suppose.